The Fake U.S. Customs Package Scam: How to Spot and Stop It

September 15, 2025

Texas Tops the Nation in Robocalls – Two Companies Face Lawsuit

September 19, 2025Big News: Trigger Leads Are (Almost) Gone!

If you’ve ever applied for a mortgage and, within hours, your phone started lighting up with dozens of unsolicited calls and texts—you’ve met the dark side of “trigger leads.”

For years, credit bureaus have sold your information the moment your credit is pulled. That means mortgage applicants instantly became targets for aggressive solicitors. Some even went as far as misrepresenting themselves with fake claims like, “I’m the underwriter on your loan.”

This week, there’s finally some good news.

The Homebuyers Privacy Protection Act Is Here

The Homebuyers Privacy Protection Act was just signed into law, and it’s designed to stop one of the most frustrating (and invasive) practices in lending.

Here’s what changes:

-

Your personal information can no longer be sold as a trigger lead unless you’ve given explicit consent.

-

Companies can only use your info if they already service your loan.

-

Banks or credit unions you already do business with can continue to reach out.

That’s a big shift toward putting borrowers back in control of their own data.

The Catch: It’s Not Immediate

The law is a win for consumer privacy, but there’s a delay. These protections don’t officially kick in until March 5, 2026.

That means we’ve still got over a year of potential spam calls and texts fueled by trigger leads. But don’t worry—you can still protect yourself in the meantime.

How to Protect Yourself Right Now

Until the law goes into effect, here are steps you can take to shield yourself from unwanted calls and texts:

Opt out at optoutprescreen.com

Remove your name from marketing lists that credit bureaus sell to lenders and solicitors. This helps reduce the flood of unwanted calls and texts triggered by credit pulls.

Freeze your credit

Lock your credit file with all three major bureaus—Equifax, Experian, and TransUnion. It’s free, prevents new accounts from being opened in your name, and gives you stronger control over your personal data.

Check your credit reports regularly

Visit annualcreditreport.com to access free weekly reports. Monitoring your reports makes it easier to catch suspicious activity early and act quickly if something looks off.

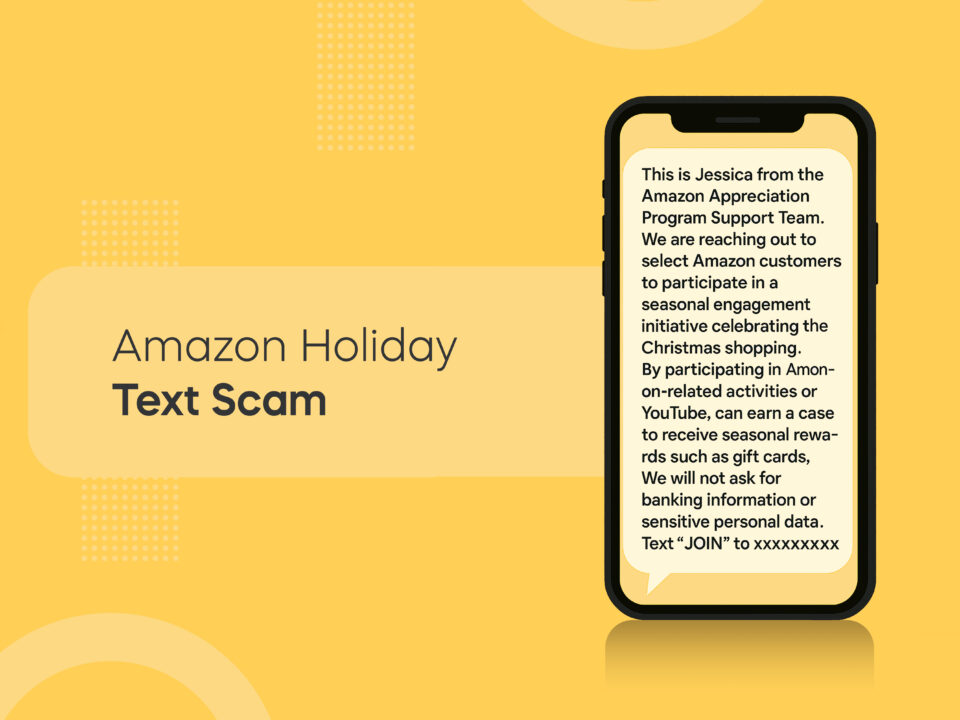

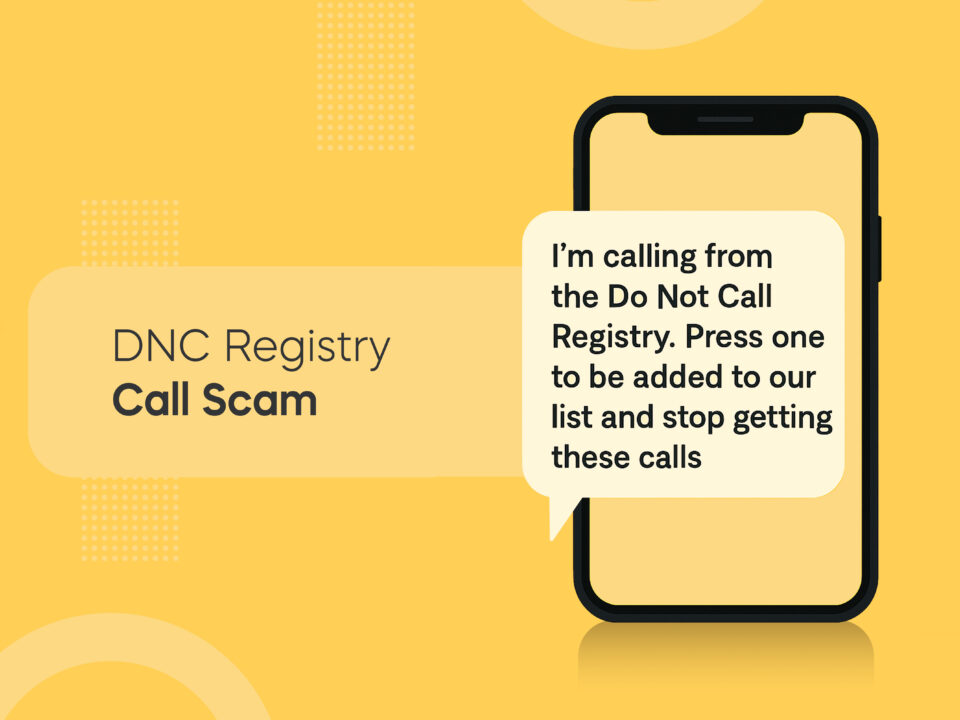

Block spam calls & texts

Use Nomorobo to stop scams before they reach you. By intercepting robocalls and fraudulent texts in real time, Nomorobo helps protect your privacy, identity, and peace of mind.

Don’t Wait for 2026 — Take Control Today

The Homebuyers Privacy Protection Act is a huge step forward, but until March 2026, the trigger-lead problem hasn’t disappeared. Scammers and aggressive marketers will continue to exploit it.

That’s why it’s more important than ever to combine smart privacy moves with proven call-blocking protection.

At Nomorobo, we’ve been fighting back against spam calls and texts for over a decade. Whether it’s fraudulent lenders, robocalls, or scam texts, our technology stops them before they ever reach your phone.

Sign up today and stay one step ahead of unwanted calls.