Jury Duty Scam Exposed: Fake Arrest Threats Targeting Your Wallet

October 3, 2025

Nomorobo Sues Synchrony Financial Over Alleged Illegal Robocalls

October 20, 2025How to Protect the Elderly From Scams

Elderly people are common targets for scams and fraud. Criminal acts of fraud are always a concern, but those worries can be amplified when it comes to elderly loved ones who may not be well-versed in using technology.

Generation gaps can cause communication and trust challenges. With technologies advancing rapidly, that gap continues to widen, giving fraudsters the chance to take advantage. To keep loved ones safe, scam protection for seniors is an important consideration.

Here are some insights into how to protect the elderly from scams.

The Continual Rise in Senior Scams

As technology evolves, so does the number of potential scams targeting senior citizens. It's an unfortunate part of modern life, but with over $3 billion taken from the elderly annually in fraudulent scams, the number is continuing to rise at an alarming rate.

With the senior population growing, this issue isn't likely to go away anytime soon. For this reason, protecting seniors from scams is a responsibility we should all take to heart. However, to ensure you can help prevent fraudulent activities, it's important to learn the commonly used types of scams aimed at this group.

Common Types of Elderly Scams

There are many types of scams and other fraudulent practices aimed at seniors to be wary of. The following are some of the most common scams criminals use to target older individuals:

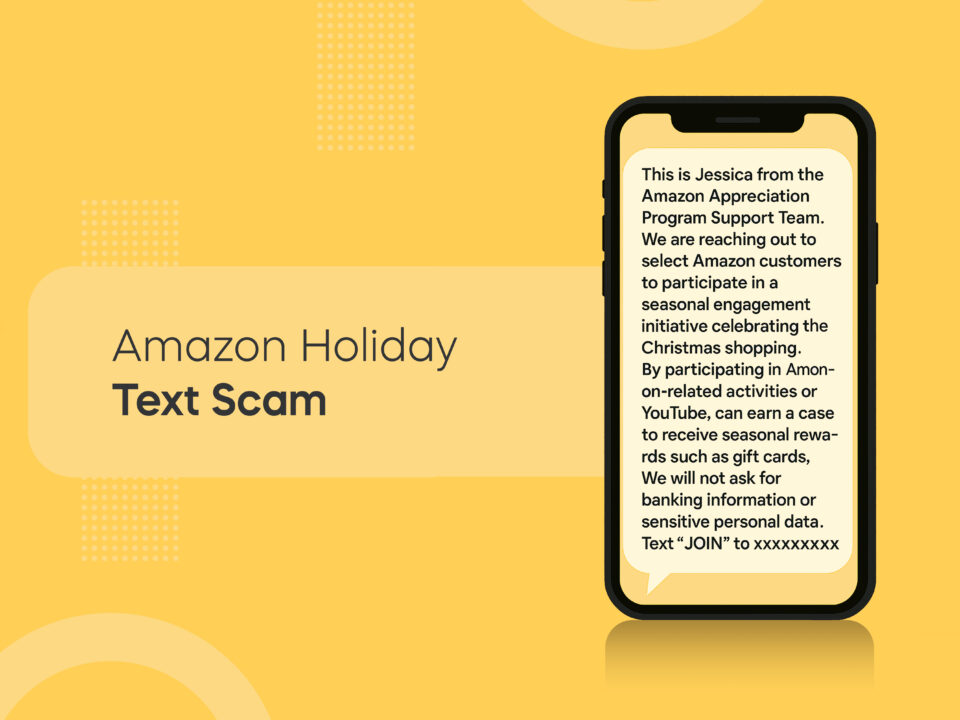

- Tech support scam: A scammer may call and claim to be from a known company and insist on payment to resolve a nonexistent account problem. They may also ask for computer access, which they can then use to install software to steal personal and financial data.

- Government impersonator scam: A scam involving someone who poses as a member of the government (usually claiming to be from the IRS or Social Security) to steal personal information. Protecting seniors from scams involving fake government representatives can be difficult due to their official-sounding nature.

- Charity and lottery scams: A scammer will pretend to work for a well-known charity to gain instant trust with an elderly citizen or claim that the target has won a lottery to obtain sensitive information.

- Romance scams: These scams involve using a false identity on dating sites or social media to begin a romantic relationship. The scammer will then leverage this emotional connection to steal or borrow money.

- Child or grandchild scam: A scammer may call claiming to be a child or grandchild of the targeted elderly person and pretend to need immediate funds.

- Family member or caregiver scam: This scam involves real caregivers, neighbors, or members of the target's own family who take advantage of the target's age to steal money.

The Dangers of Not Protecting Seniors from Scams

Knowing how to protect vulnerable people from scams can help prevent them from experiencing a range of negative effects, financial and otherwise, including:

- Significant financial losses, including retirement plans, life savings, and family member inheritance.

- Loss of independence due to the inability to recoup lost assets.

- Reduced confidence, happiness, and mental health due to emotional distress.

- Social impact due to fear and lack of trust in others.

How to Identify a Scam Aimed at Seniors

It's not always easy to spot a scam, especially with artificial intelligence (AI) technologies being used for vocal cloning in fraudulent scams. Nonetheless, whether you're protecting elderly parents from scams or being a good neighbor who is concerned about a senior resident, spotting the signs of a scam is important.

1. Urgency

Any scenario involving an urgent, immediate request for money is worth your skepticism. Reputable and professional organizations don't call customers in a panicked tone, insisting on immediate action without clear context and a solid explanation.

2. High-Pressure

Calls, emails, or texts that insist on an elderly person making an immediate decision on something should also ring alarm bells. To protect seniors from fraud, always advise them to consult you if they get any correspondence asking them to make an instant decision, or requests not to discuss the matter with loved ones.

3. Unconventional Payment Methods

Organizations, particularly reputable ones that elderly people may be long-term customers of, will never ask for payment in the form of digital gift cards or cryptocurrency. This is a commonly used method for scammers, and something no trustworthy business would ask for.

4. Requests for Sensitive Information

A scammer may call and ask for card details or a Social Security number. While legitimate companies may ask for this kind of information, it's always best to challenge this, especially when combined with a sense of urgency or pressure to provide it.

5. Poor Grammar or Odd Contact Information

Bad grammar in texts, letters, or emails can be a big signifier of a scam. It's easy for scammers to use an official company email address, insert an inconspicuous number or letter, then present it as an official email. To protect the elderly from scams, encourage them to avoid phone numbers that aren't official to the company the caller claims to be from, and to check email addresses carefully.

How to Help Old People Avoid Scams

Implement the following methods to improve awareness and protect seniors from fraud.

- Choose a safe word: Select a secret code, word, or phrase that's shared only between a trusted few. Insist on this word being used in the event of a call or message that involves financial matters.

- Two-factor authentication: If you're protecting elderly parents from scams but they don't like technology, sit with them and help them set up two-factor security measures on their devices.

- Discuss suspicious links: Encourage elderly people to exercise caution if they receive a text or email with a link attached. If there is even 1% doubt, do not click on an external link.

- Threatening behavior: Most seniors have impeccable manners on the phone and may not want to question an urgent request. If sensible questions are met with a threatening response, it's a sign of a scam.

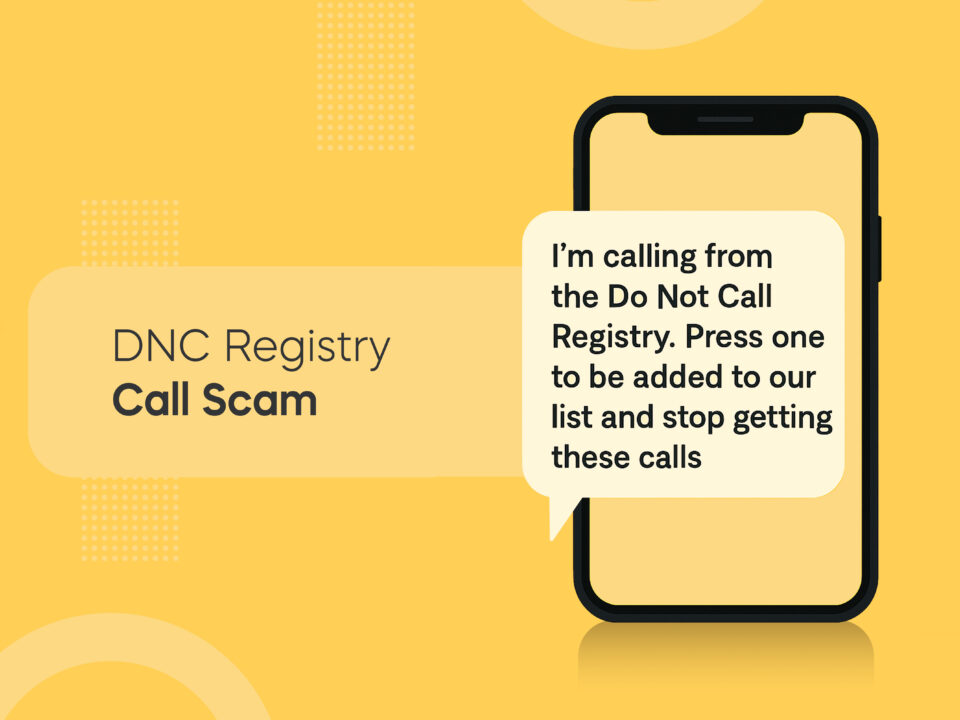

- Fake caller IDs: Software and AI innovations have made scam calls sound eerily official. They can also make it seem like calls are coming from local area codes and legitimate sources. Any unrequested call is best left unanswered, as it can always be checked afterwards.

Finally, scam protection for seniors isn't always about preventive measures. If you know an elderly person who has been targeted by a financial scam, contact the Consumer Financial Protection Bureau immediately.

Turn to Nomorobo for Easy Scam Protection for Seniors

Nomorobo's app makes protecting seniors from scams simple. By harnessing the best technologies to help avoid scam calls, our intuitive app has helped over one million users protect their smartphones and Voice over Internet Protocol (VoIP) landlines.

Nomorobo automatically blocks spam and scam callers while letting trusted calls in. We have the largest number of sensors and 7 million VOIP customers, giving us the most accurate data.

Sign up to start preventing scams, spam, and fraudulent calls and texts today.